Investment Case

WHSmith

Over 1200

STORES IN TRAVEL LOCATIONS

WHSmith is a leading global travel retailer with over 1,200 stores, primarily serving the world’s leading airports, as well as in hospitals, rail, and motorway service stations in the UK.

We are the trusted home for travel essentials delivered through our innovative one-stop-shop format. We offer a wide range of high quality products for travelling customers across food & beverage, health & beauty, books and tech accessories, and we are constantly innovating to meet our customers’ and partners’ needs, and deliver strong returns.

With our focus on higher growth travel markets, the Group, earlier this year, announced the sale of its UK High Street business. The sale of our High Street business completed on 30 June 2025. As a result of this sale, WHSmith is now a pure play travel retailer. With the ongoing strength in our UK Travel division, and the scale of the growth opportunities in both our North America and the Rest of the World divisions, we are in a strong position to deliver enhanced and sustained growth in revenue and profitability.

Travel Retail is a large and fast growing market

The travel retail market is substantial, driven by rapidly growing passenger numbers which are forecast to grow 2.5x from 2024 – 2050 as international markets expand and develop.

The exciting growth in these markets sees landlords making significant investment into airport infrastructure globally, with high demand for quality retail offerings. The travel retail market is highly fragmented, and the adaptability of our teams and brand provides us with a substantial opportunity to capture significant market share.

We operate a scalable business model which allows us to operate in over 30 countries globally, using a variety of retail brands including WHSmith, InMotion and a wide range of bespoke formats in over 1200 stores worldwide.

Among our most important markets is the UK, where we operate more than 500 stores in key travel locations. We also operate more than 350 stores in the US, the world’s largest travel market. Our stores trade under a variety of different brands and we have an estimated current market share of c.14%. Our target is to grow our market share of the North American travel retail market to c.20% by 2028.

We have strong partnerships with landlords across the globe and our market-leading store design, range breadth and forensic approach to retailing allows us to deliver superior economics from innovative formats across different travel locations for our partners and customers. These characteristics underpin our ability to generate substantial growth and value for our shareholders.

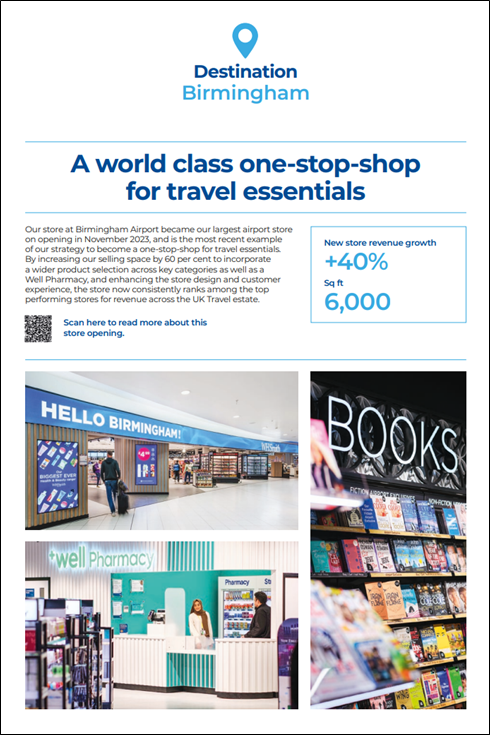

Case study: Birmingham Airport

Our strong and clear strategy

We have a strong and clear strategy which allow us to capture the significant growth opportunities in travel retail and underpins our vision to be the world’s number one travel essentials retailer. There are four pillars to our travel strategy:

- Space Growth

- ATV Growth

- Category Development

- Cost and Cash Management

Space Growth

Central to our strategy is to increase the quality and quantity of the space we operate in. This process includes our ability to develop our formats and reposition our store estate to better quality locations. We are in a strong position to continue the growth of our store estate across existing and new markets. We have a strong record in winning new space.

ATV Growth

For many years increasing the average transaction value and conversion rates has been a feature of our approach to retail. Our global operations mean we have unique insight into the travelling customer and can tailor our ranges and quickly respond to changing customer preferences.

Category development

A significant feature of our approach to retail growth has been to broaden our categories – in recent years we successfully expanded our store ranges to include premium food, health and beauty and tech accessories.

Cost and cash management

Underpinning everything we do is a continued focus on the disciplined management of our businesses and tight cost controls, with a particular focus on cash.

Rewarding our shareholders

We remain focused on maintaining an efficient balance sheet and our disciplined approach to capital allocation.

The first pillar of our policy is to invest in the business where returns are ahead of our cost of capital.

Secondly, our commitment to a progressive dividend policy is well established, and we seek to grow our dividends at least in line with EPS growth, with a target dividend cover of around 2.5x.

We also have a strong track record of making selective value creating acquisitions, and we will continue to look at opportunities as they arise.

Finally, we have a long track record of returning excess cash to shareholders via share buybacks.

Environment and Social Governance

We have excellent sustainability credentials, and we continue to make good progress. We know that operating sustainably enables better business performance.

We are one of the top performing speciality retailers in Morningstar’s Sustainalytics ESG Benchmark and currently have an ESG rating of AAA from MSCI. In addition we are included in the Dow Jones World Sustainability Index and awarded an A rating in CDP’s annual climate leadership survey.

Our Scope 1 and 2 emissions continue to fall and nearly 50% of our supply chain emissions are now covered by science-based targets.

We continue to champion children’s literacy in partnership with the National Literacy Trust. Our financial assistance is providing direct early years’ support to families in communities where help is needed.